Innovative Solutions for Specialty Financial Data in the REIT Sector and on Demand

Innovative Solutions for Specialty Financial Data in the REIT Sector and on Demand

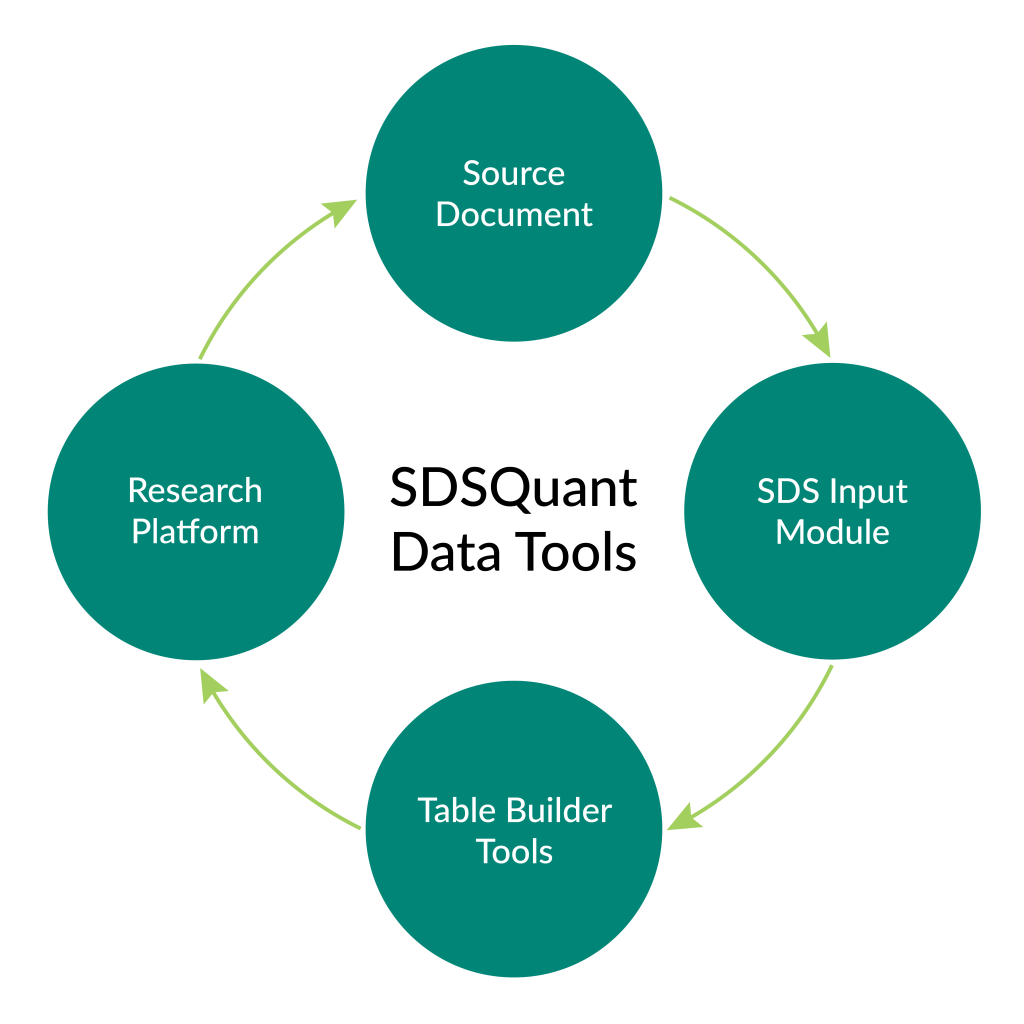

What is SDSQuant?

REIT Data

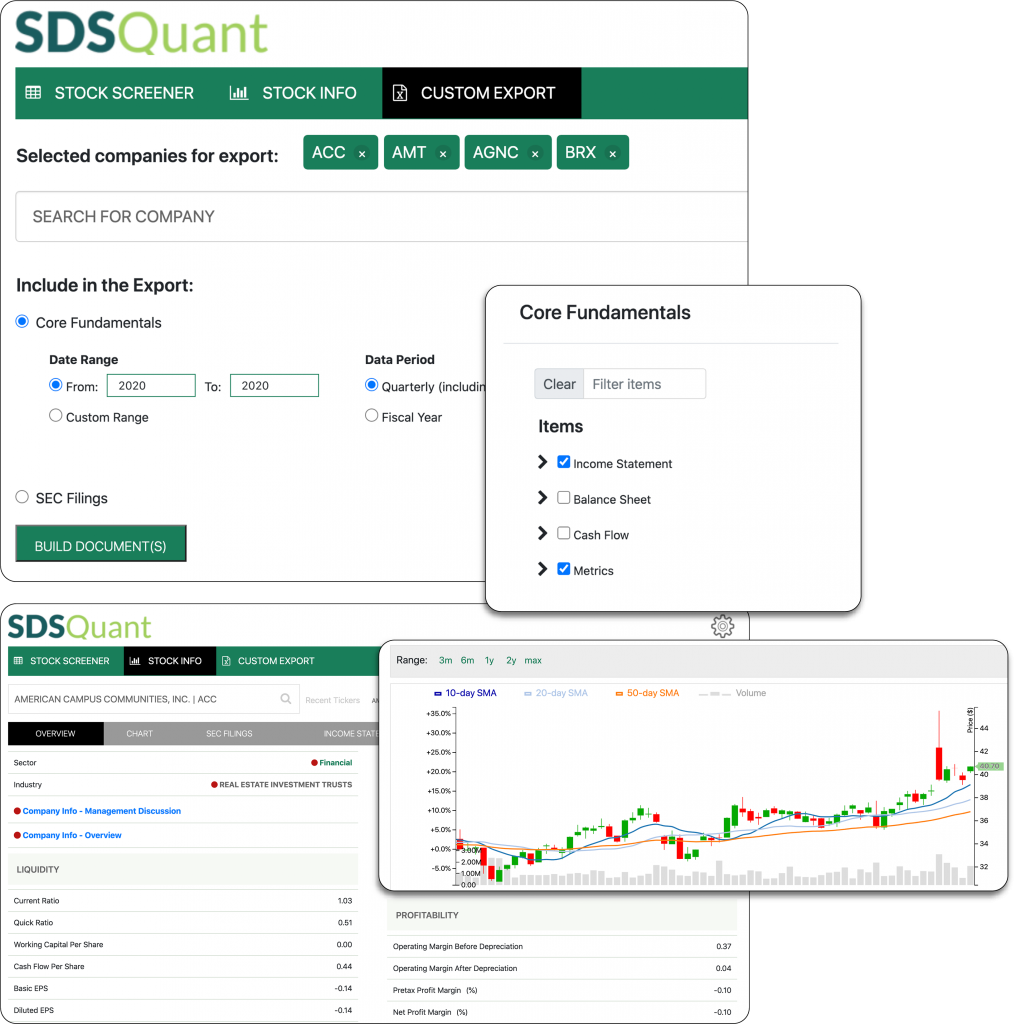

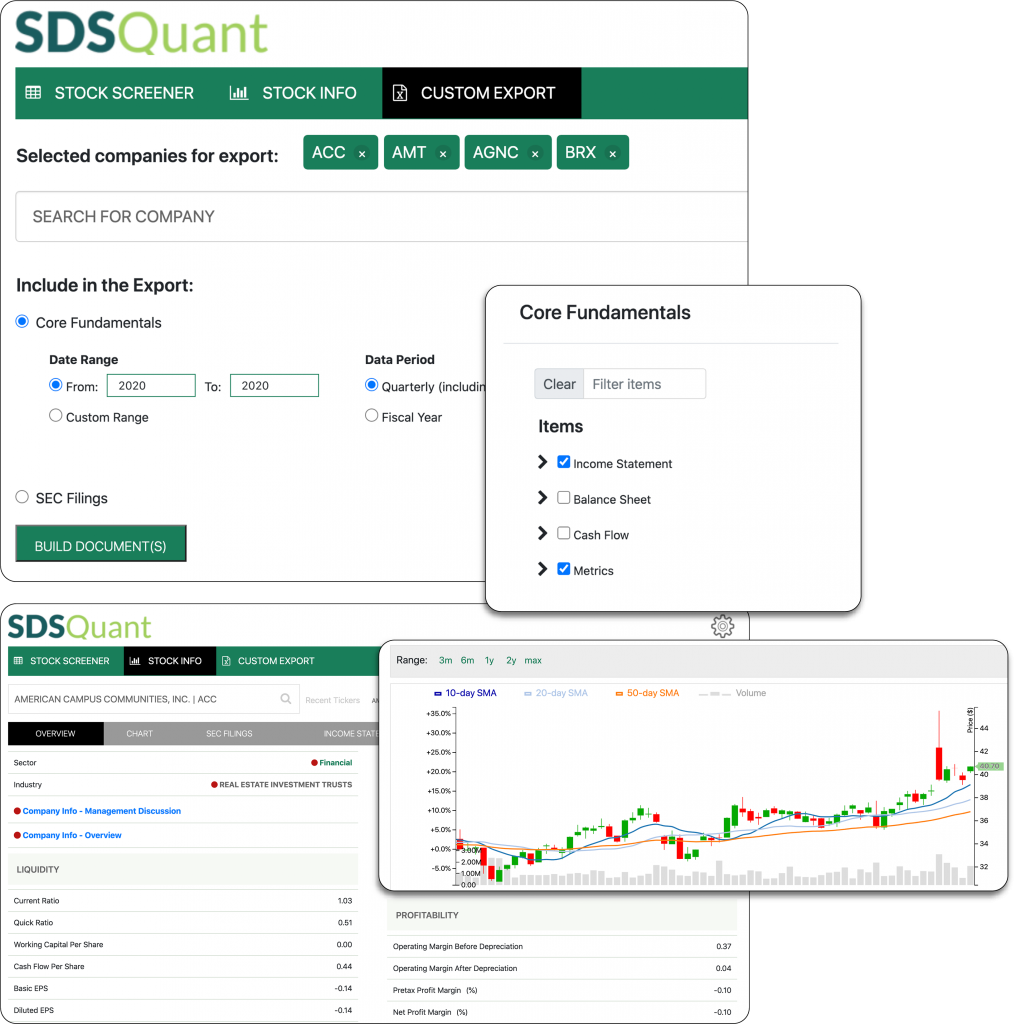

APIs and Exports

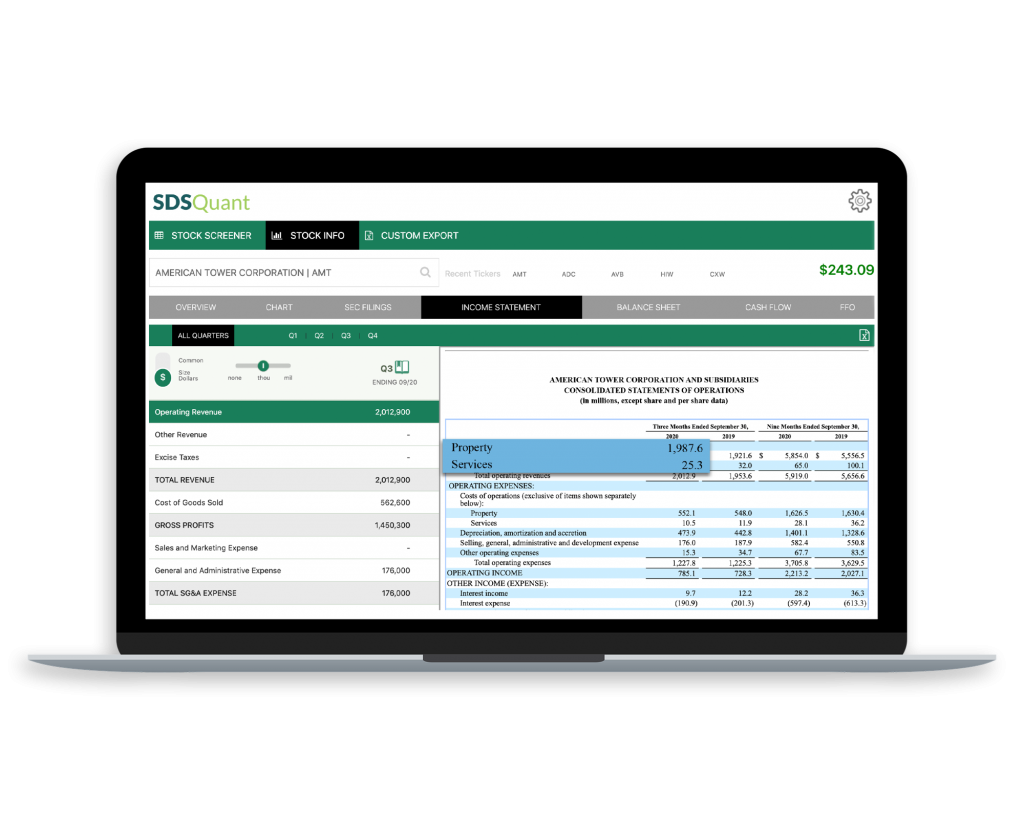

Research Platform

Available tables: Income Statement, Balance Sheet, Cash Flow, Funds From Operations (FFO).

Metrics for Liquidity, Activity, Leverage, Performance, Profitability, Price and Valuation Multiples.

Charts and current pricing information.

Custom views and sortable columns.

Unlimited exports of all or selectable data (choose what you need).

Take our research platform for a spin.

FAQs

We have the capability of mining all fundamentals (income statement, balance sheet, cash flow) for all US publicly traded companies going back over 10 years. However, we have focused on REITS due to existing client interest. We plan to expand our public coverage in the near future.

Not at the moment. We review and approve all account requests to determine that they’re from a legitimate source. We do this because clients can export our entire database from the Research Platform, and we want to mitigate fraud and theft.

Our system is capable of harvesting any data that is in filings submitted to the SEC. Once a taxonomy is mined, it can be used to acquire historical data as well.

This depends on the complexity of the query, and how standardized the “as reported” specialty data is. Please contact us, and we can investigate and provide a quote.